My Real Estate Blog - Market Trends, Tips & Updates

Big banks and lenders slash mortgage rates in time for the holidays

12/21/2023 | Posted in Mortgage Interest Rates by Paul DeAdder | Back to Main Blog Page

Several of Canada’s big banks and numerous other lenders are offering a practical gift for borrowers this holiday season: lower mortgage rates.

After an initial round of rate cuts earlier in the month, mortgage lenders are once again dropping fixed mortgage rates across the board.

Over the past week, Scotiabank, RBC, CIBC and BMO have slashed select special rates by as much as 70 basis points, or 0.70%. Rate reductions are also being seen across all mortgage terms by national and provincial brokerages and credit unions.

Ron Butler of Butler Mortgage told CMT the bulk of the cuts are primarily to high-ratio insurable products (i.e. not those available for refinances or with amortizations over 25 years).

“These products have the most direct relationship to bond yields via securitization,” he said. “Conventional rates move down more slowly as they have a mixture of funding sources and different credit swap costs.”

One month ago, the lowest deep-discount, nationally available insured 5-year fixed rate was 5.29%. Today, borrowers can find those rates as low as 4.89%, according to MortgageLogic.news.

“Yields have stabilized a slight bit, so lenders will feel a little more comfortable reducing rates a bit here,” says mortgage broker and former investment banker Ryan Sims.

While there have been some sizeable rate reductions, Sims notes they haven’t matched bond yields “basis point for basis point.”

“There is still a large premium over Government of Canada bond yields on the rates right now, and lenders have some super [net interest margin] spread here,” he notes. However, he added those risk premiums may be needed should the economy enter a more severe downturn and result in larger loan losses for lenders.

What’s behind this latest round of rate cuts?

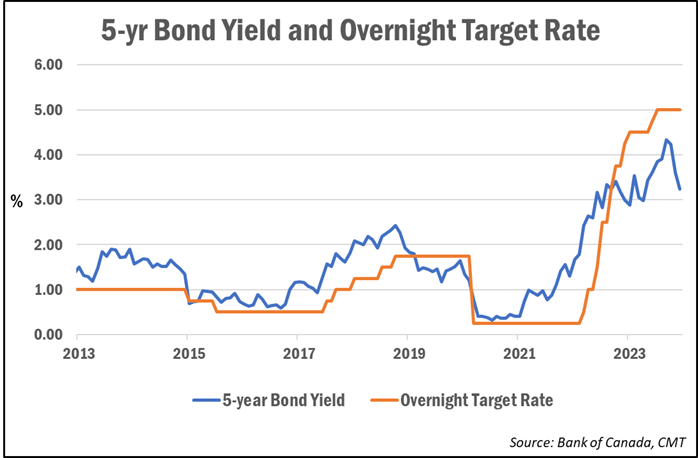

Fixed mortgage rates typically follow Government of Canada bond yields, which once again plummeted last week following dovish comments from Federal Reserve Chair Jerome Powell.

The Government of Canada 5-year bond yield is now down more than a full percentage point from its recent high. As of Thursday, it closed at 3.24%, down from a high of 4.42% in early October.

Powell’s comments boosted market confidence that rates have now reached their peak and will start falling at some point in 2024.

After the Federal Reserve left rates unchanged at its policy meeting last week, Powell said the central bank’s policymakers “think it’s not likely that they’ll hike…” He also conceded that the Fed would start easing before U.S. inflation returns to 2%, saying, “We’re aware of the risk that we would hang on too long.”

On this side of the border, Bank of Canada Governor Tiff Macklem acknowledged on Monday that interest rates may come down “sometime in 2024.”

“We are certainly feeling more confident that monetary policy is working and increasingly, the conditions are in place to get us back to two-per-cent inflation, but that is not yet assured, we’re not there yet,” Macklem said in an interview with BNN Bloomberg.

Looking ahead

In Canada, bond markets are currently pricing 17% odds of a rate cut as early as January. While that’s unlikely, most economists do expect the first Bank of Canada rate reductions—which would impact variable mortgage rates—by around mid-year.

Markets are pricing in a 94% chance of three quarter-point cuts by June. Meanwhile, forecasts from most of the Big 6 banks see the overnight target rate falling back to 4.00% by the end of 2024 from its current rate of 5.00%. Several even see it falling as far as 3.50%.

That in turn would lower the prime rate, upon which variable-rate mortgages and lines of credit are priced.

While variable-rate pricing has largely remained unchanged in recent weeks, some believe variable rates will be the best option for borrowers who are facing a renewal or are in the market for a new mortgage.

“If you’re in the market for a mortgage today, variable rates are an appealing option—if you can tolerate variable-rate risk and are prepared to be patient,” wrote mortgage broker Dave Larock of Integrated Mortgage Planners.

“Simply put, I think variable rates will most likely produce the cheapest total borrowing cost over the five years ahead,” he added. “On the other hand, if you’re concerned that inflation will prove stickier than the consensus now expects…think 3-year terms are the best currently available fixed-rate option.”

Source: Canadian Mortgage Trends