My Real Estate Blog - Market Trends, Tips & Updates

Bond yields surge to new heights, mortgage rates expected to jump another 20 bps

10/4/2023 | Posted in Mortgage Interest Rates by Paul DeAdder | Back to Main Blog Page

“It ain’t good.”

That’s the assessment from Ron Butler of Butler Mortgage following the latest surge in bond yields this week, and as mortgage providers continue to raise mortgage rates.

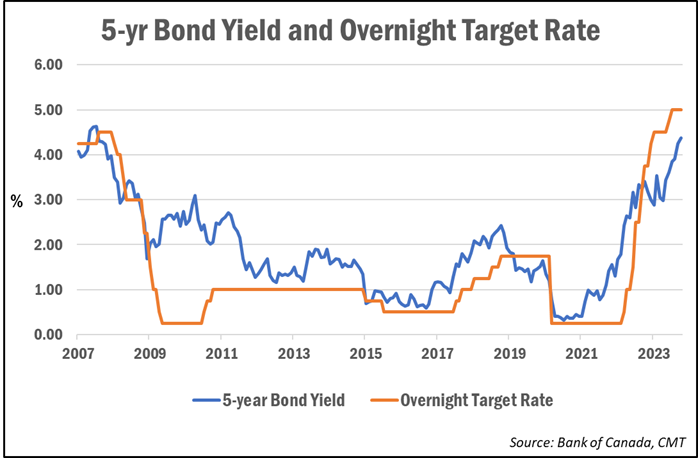

On Tuesday, the Government of Canada 5-year bond yield jumped to an intraday high of 4.46%, but have since retreated to around 4.32% as of this writing. Over the past two weeks, yields have risen by over 30 basis points, or 0.30%.

Since bond yields typically lead fixed mortgage rate pricing, rates have been steadily on the rise. And rate-watchers say that’s likely to continue.

Butler told CMT he expects rates to rise another 20 bps or so by Friday.

Following this latest rise, by and large the only remaining discounted rates under 6% will be for default-insured 5-year fixeds, meaning those with a down payment of less than 20%. Conventional 5-year fixed mortgages will be right around 6%, or just a hair under, Butler notes.

Two-year fixed terms are now all in the 7% range, while 3-year terms are now starting to break the 7% mark, Butler added.

Higher-for-longer rate expectations driving latest increases

The biggest driver of this latest surge in yields is due to markets re-pricing the “higher-for-longer” expectation for interest rates, as well as expectations that Canada will avoid a serious recession, says Ryan Sims, a rate expert and mortgage broker with TMG The Mortgage Group.

In a recent email to clients, Sims explained the reason for falling bond prices, which is leading to higher yields, since bond prices and yields move inversely to one another.

Since the interest rates offered on newly issued bonds has been rising, it has made older bonds with lower rates less attractive. This means those older bonds need to be sold for a lower price in order to make the investment worthwhile for the purchaser.

“When yields ( interest rates ) are up, then the price of the bond is down,” Sims explained. “Bond prices have dropped quite substantially since March of 2022 and are on track for one of their worst track records since the late 1970s.”

While rising interest rates can be a problem, Sims noted that falling bond values can also be a concern for bond owners, with Canada’s big banks being among some of the largest holders of bonds.

“As bond prices drop, they must set aside more capital against dropping prices, which in turn leads to needing higher margin on funds they loan out on new mortgages—and around and around we go,” Sims wrote.

Could 5-year fixed mortgage rates reach 8%?

Sims had previously told CMT that 4% was a major resistance point for bond yields. Since they’ve broken through that, he said 4.50% is the next major hurdle.

“Here we are knocking on the door. If we break 4.50%, we could zoom to 5.00% very easily,” he said.

“If we see further highs on the Government of Canada 5 year bond yield, then who knows how high we go. It is completely possible, based on some technical charts, to see a 5-year uninsured mortgage around the 8% range,” Sims continued. “Although that would take another leg up in yields and higher risk pricing to achieve, but it is certainly possible. It’s not my base case at this point, but certainly in the realm of possibilities.”

While an 8% 5-year fixed-rate mortgage from a prime lender is only hypothetical at this point, today’s new borrowers and those switching lenders are in fact having to qualify at 8% (and higher) rates due to the mortgage stress test, which currently qualifies them at 200 percentage points above their contract rate.

The pain being felt at renewal

Over a third of mortgage holders have already been affected by higher interest rates, but by 2026 all mortgage holders will have seen their payments increase, according to the Bank of Canada.

Mortgage broker Dave Larock of Integrated Mortgage Planners told CMT recently that those with fixed-rate mortgages have so far largely avoided the pain of higher rates that’s been more prominently felt by variable-rate borrowers. But that’s now changing as about 1.2 million mortgages come up for renewal each year.

“They know higher payments are coming and it hangs over them like the sword of Damocles,” he said.

Data from Edge Realty Analytics show that the monthly mortgage payment required to purchase the average-priced home has risen to nearly $3,600 a month. That’s up 21% year-over-year and over 80% from two years ago.

Source: Canadian Mortgage Trends