My Real Estate Blog - Market Trends, Tips & Updates

First-time buyers relying on gifted down payments more than ever

7/29/2024 | Posted in First Time Home Buyers by Paul DeAdder | Back to Main Blog Page

Mortgage down payment gifts from family members remain a crucial factor for first-time homebuyers in Canada, even as the housing market cools and economic conditions tighten.

First-time homebuyers in Canada remain heavily reliant on financial gifts for down payments, even as economic conditions have tightened.

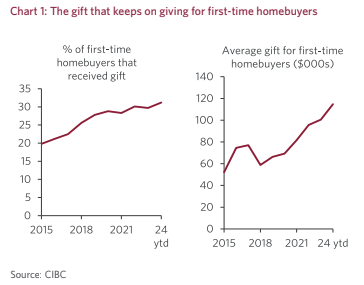

According to a recent study by CIBC, 31% of first-time buyers received family help for their down payment, a significant increase from 20% in 2015.

Despite a cooling housing market post-COVID, the average gift amount has risen to $115,000, up 73% since 2019. This highlights the ongoing critical role of family wealth in home purchasing, which is helping mitigate housing inflation, but is also widening the wealth gap, CIBC notes.

For those upgrading to larger homes, known as “mover-uppers,” 12% received gifts, with an average amount of $167,000, according to CIBC.

The correlation between gift amounts and home prices remains strong, with gifts continuing to increase even as home prices have fallen 14% from their COVID-era peak. This increase in gift sizes is likely facilitated by parents downsizing and benefiting from high home prices when selling their primary residences, according to the report.

In Ontario and British Columbia, where housing affordability is particularly stretched, 36% of first-time homebuyers received gifts, compared to the national average of 31%. The average gift amount in B.C. is $204,000, while in Ontario it’s $128,000.

Since 2019, gift amounts have increased by 90% in B.C. and 52% in Ontario, reflecting the high cost of homeownership in these regions.

Interestingly, mover-uppers in Ontario and B.C. are not more likely than the national average to receive gifts, but the amounts they receive are higher. In Ontario, the average gift is $189,000, and in B.C., it is $230,000, compared to the national average of $167,000.

This phenomenon helps mitigate the impact of housing inflation for buyers but also contributes to the widening wealth gap in Canada. As home prices remain high, the trend of relying on family gifts for down payments is likely to continue, highlighting the ongoing challenges of housing affordability in Canada.

Source: Canadian Mortgage Trends