My Real Estate Blog - Market Trends, Tips & Updates

Rent prices are up $175 in the past six months and have pushed rent inflation to a 30-year high

11/14/2023 | Posted in Rental Market by Paul DeAdder | Back to Main Blog Page

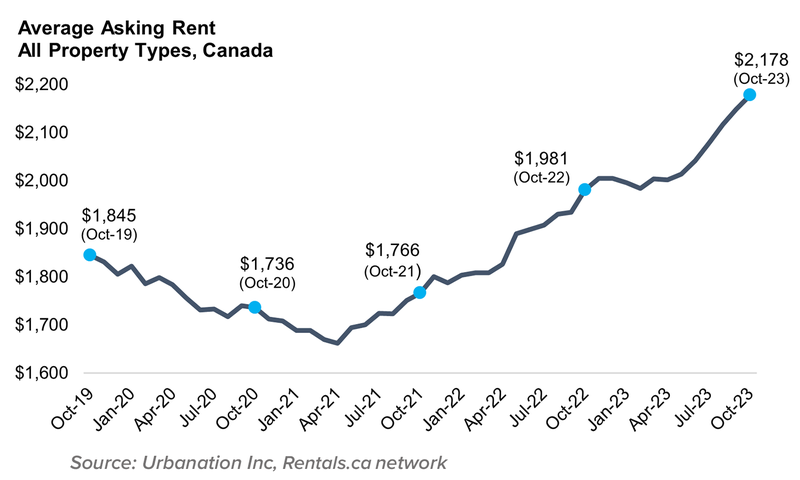

The average asking rent in Canada has increased by about $175 over the past six months, and is now nearly 10% higher compared to a year ago.

As of October, the average rent price for all unit types reached $2,178, according to data from Rentals.ca‘s latest monthly data. That’s up 1.4% compared to September, but slower than the 1.8% monthly increase seen back in August thanks to seasonable factors.

One-bedroom rent prices were up a whopping 29% year-over-year in Red Deer, Alberta, while Halifax, NS (+20.6%) and Markham, ON (+20%) also saw outsized gains.

The national average rent for two-bedroom units has now surpassed $2,300 a month, up 1.7% from September and +11.7% compared to a year ago. The largest increases were seen in Oakville, ON (+23.5%) and Quebec City, QC (+17.6%).

High rents are contributing to inflation

Average rents in Canada are now up over 31% compared to the low of $1,662 reached in April 2021.

This steep rise means rent prices are now a leading contributor to the country’s headline inflation rate, which the Bank of Canada is desperately trying to bring back to its target rate of 2%.

As of September, rent inflation has shot up to 7.3%, according to data from Statistics Canada—the fastest pace since 1983. It’s now the second leading contributor to overall inflation, after mortgage interest cost, which is up 30.6%.

On a monthly basis, rent inflation from August to September was 0.8%. That means that of the headline CPI inflation reading of 3.8% in September, 0.8% came from rent inflation alone. Another 2.6% came from mortgage interest cost.

“It’s a big issue,” noted analyst Ben Rabidoux of Edge Realty Analytics. He pointed to the more than 700,000 non-permanent residents added to the population over the past 12 months—which includes international students and foreign workers—as a major contributing factor to the upward pressure on rent prices.

In response to housing affordability concerns, the federal government recently announced it plans to level out its targets for new permanent residents coming to Canada. The target for 2024 and 2025 will increase as planned to 485,000 and 500,000, respectively, and hold steady at 500,000 in 2026.

“These immigration levels will help set the pace of Canada’s economic and population growth while moderating its impact on critical systems such as infrastructure and housing,” Immigration Minister Marc Miller said.

Alberta leads the provinces in rent price growth

Rentals.ca reported that Alberta once again posted the fastest year-over-year increase in rent prices, which were up 16.4% in October to $1,686.

nts were also up sharply in Nova Scotia (+13.6%) and Quebec (13.3%), thanks to both strong population growth and “large infusions of new rental supply priced at above-average market rents,” Rentals.ca noted.

The slowest annual increases were once again seen in Manitoba (+5.5%) and Saskatchewan (+4%).

Calgary and Montreal lead rent growth in Canada’s largest cities

Calgary continued to lead rent price growth in October, with an average year-over-year increase of 14.7% to reach $2,093. Montreal saw the second-fastest pace of growth at 10.8%, with an average price of $2,046.

Here’s a look at the year-over-year rent increases in some of the country’s key markets:

- Calgary, AB: +14.7% ($2,093)

- Regina, SK: +13.7% ($1,273)

- Montreal, QC: +10.8% ($2,046)

- Ottawa, ON: +10.6% ($2,197)

- Halifax, NS: +9.5% ($2,017)

- Winnipeg, MB: +7.4% ($1,521)

- Vancouver, B.C.: +4.4% ($3,215)

- Toronto, ON: -0.8% ($2,908)

Source: Canadian Mortgage Trends